On Monday, July 30, 2025, the 2026 Fiscal Year State Budget was signed into law by Governor

Murphy, which includes a significant change to real estate closing costs. Effective July 10, 2025,

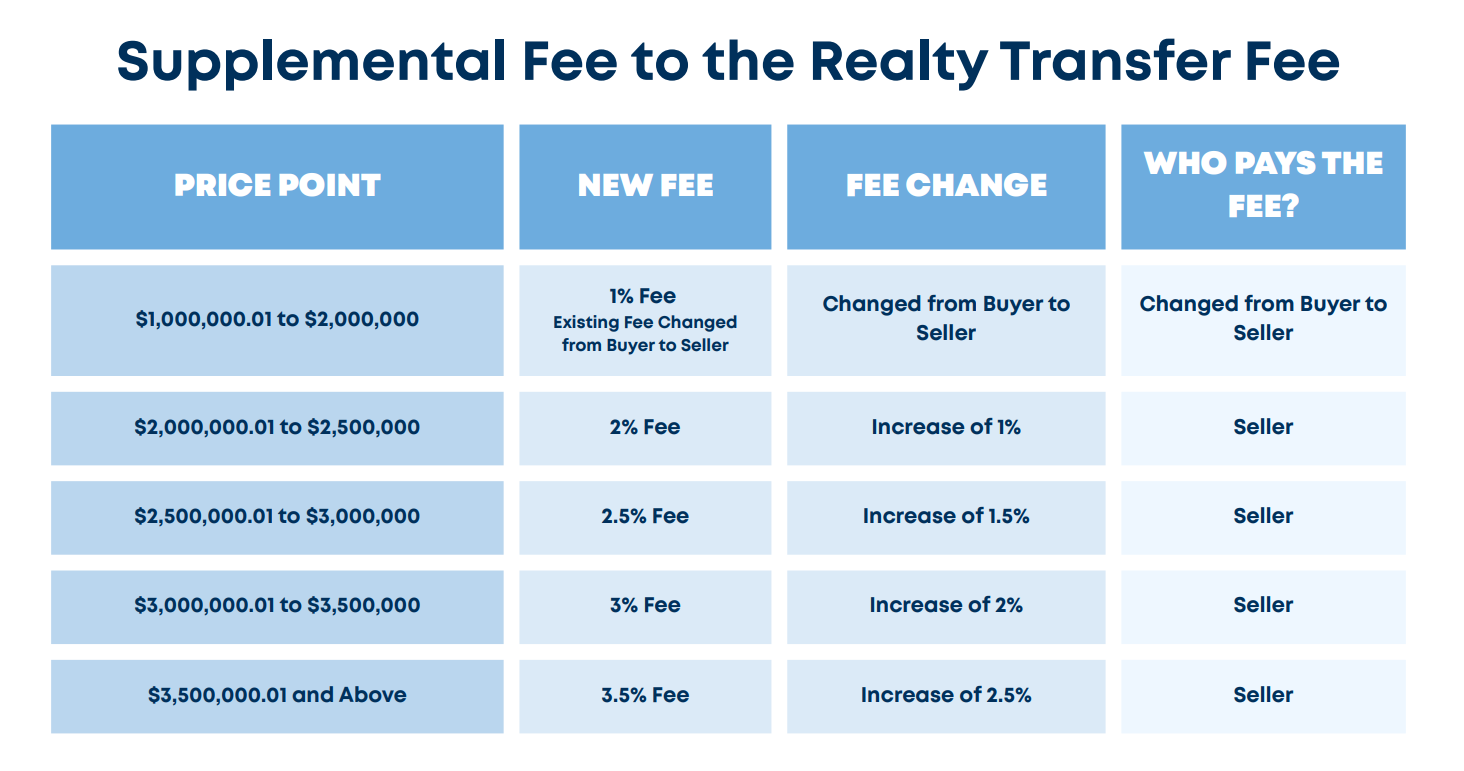

a new graduated tax on high-end property sales will go into effect. This tax, known as the

“Supplemental Fee to the Realty Transfer Fee," is separate from the existing Realty Transfer Fee

and replaces what some called the “Mansion Tax.” This update modifies the supplemental fee

structure, notably on properties over $2 million, shifting the responsibility to sellers and

expanding progressive tiers.

Previously, this tax was a flat 1% on anything over $1 M paid by the buyer. nj.gov

Who Pays?

- Supplemental fee: As of July 9, 2025, the seller, not the buyer, is responsible—aligning

with the base RTF https://bit.ly/3GrltQI -

Base Realty Transfer Fee: Still paid by the seller, with graduated tiers based on sale price

https://bit.ly/40t1rvW

What This Means for Buyers & Sellers

- Sellers of luxury properties ($2 M+) will face significantly higher closing costs.

- Buyers no longer bear this burden—though the higher cost could still influence

negotiations and pricing. - Luxury home activity could slow.

REALTY TRANSFER FEE CALCULATOR TO ASSIST

If you are looking for additional resources, please reach out to me.